National Bank of Kuwait (NBK) continues to enrich the comprehensive digital experience of clients by providing them with integrated banking and investment products, services, and solutions from NBK and NBK Capital that meet all their needs and expectations. In this context, NBK Capital has integrated the SmartWealth investment service with the NBK Mobile Banking App, which allows app users to start investing in global markets with a diversified investment plan through a quick, simplified process using just their smartphones.

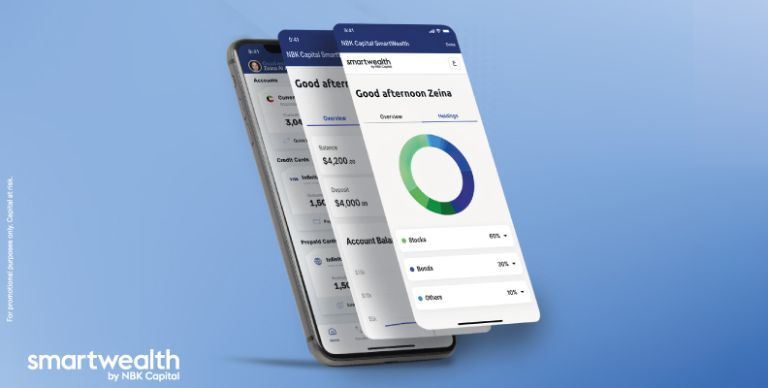

This offering is the first of its kind in the region where a bank’s clients are able to digitally open an investment account in an easy and secure way through the bank’s mobile banking app. Through NBK Mobile Banking App, SmartWealth investors will be able to open an account, view the details, holdings, and performance of their investment plan, as well as transfer money directly from their bank accounts to fund their SmartWealth investment account.

SmartWealth is a fully-digital investment service that aims to make investing easier for everyone. It targets investors planning for their long-term financial goals such as buying a home, saving for children’s education, retirement, or general investing. It provides clients with a simple, easy way to invest in multi-asset investment plans comprised of securities that provide exposure to stocks, bonds, real estate and commodities. The service also offers clients the opportunity to invest in global markets like the United States, Europe, Asia, and emerging markets using local funding methods.

These investment plans are customized to each client according to their preferred level of risk and future objectives, allowing them to save and invest their money for the long term even if they do not have any previous investing experience.

On this occasion, Mr. Hisham Al-Nusif, Deputy General Manager of Consumer Banking Group at National Bank of Kuwait said: “Enabling our clients to invest with SmartWealth through the NBK Mobile Banking App comes in line with our strategy to offer our clients an integrated digital banking experience by enriching the digital investment solutions available for them.”

Al-Nusif emphasized that NBK strives to provide all clients’ needs through the NBK Mobile Banking App, to help enrich their digital banking experience and allow them to make all their transactions anytime and anywhere.

“SmartWealth has achieved great success, as reflected in the interest of investors looking to invest their money in an easy way that suits their lifestyles and long-term future financial goals,” Al-Nusif highlighted.

SmartWealth is a service by NBK Capital, the investment arm of NBK, which provides clients with investment advice to help them in the execution of their investment plans.

Al-Nusif noted that NBK Capital always strives to provide clients with the best-in-class long-term investment solutions, spearheaded by SmartWealth’s digital investment solutions.

Clients can open a SmartWealth account through the NBK Mobile Banking app, via SmartWealth’s dedicated website and mobile app, or through the designated relationship manager at any of NBK’s Branches.

Related Business Chains: