A Positive Outlook

Crypto continues to deliver high positive returns for investors (36%), albeit with relatively higher risk when compared with other assets. Global investors continue to believe in the short-term high-growth potential of crypto and recognize its value in diversifying investment portfolios. This shared rationale for investing in crypto remains consistent across the 19 markets surveyed in wave 6 of Toluna’s Decoding Crypto report.

The study also shows that a significant number of current investors are twice as likely to allocate more assets into crypto investments (38%) rather than reduce their assets (18%) over the next six months. Moreover, the market expects a surge of new investors in the near future.

Toluna’s quarterly tracker aims to understand consumers´ investment habits, perceptions, and future purchase intent with regard to crypto building a continuous understanding of the market outlook.

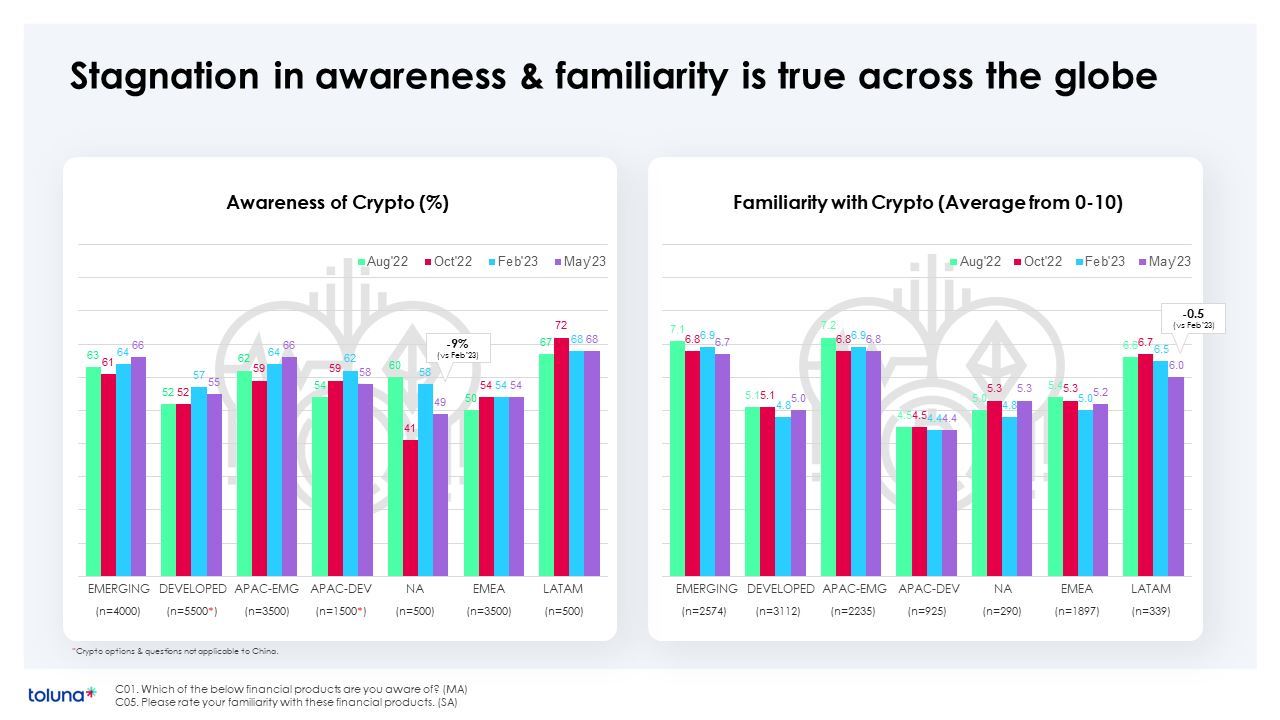

Awareness is Plateauing and Deterrents Persist

Toluna’s study reveals that despite cryptocurrency’s popularity as an investment option, only surpassed by stocks, awareness and familiarity with crypto have plateaued. While it remains a sought-after investment, people’s understanding, and knowledge have seen little to no progress over the last year.

And as cryptocurrency continues to carve its niche in the global financial landscape, reservations among potential investors persist. Concerns regarding perceived risk, security vulnerabilities, and the intricate nature of digital assets continue to act as significant deterrents. According to Toluna’s Q2 2023 study, associated risk (47%) and a lack of understanding (33%) are identified as the primary barriers to entry across markets.

Sentiment: Regional Differences

Global perceptions of crypto remain at an all-time low. In LATAM, specifically, perceptions of security (-0.6 vs Feb ’23) and trust (-0.7 vs Feb ’23) have further declined in Q2 ’23. Even worse, their optimism (-9% vs Feb ’23) and excitement (-6% vs Feb ’23) have waned while uncertainty has continued to brew (+7% vs Feb ’23).

In Emerging APAC, NA, and EMEA, consumers have recently perceived greater risk with crypto, but sentiments have grown more positive in Q2 ’23. Investors in these markets are more optimistic (+4 to 5% vs Feb ’23), excited (+4 to 5% vs Feb ’23) and inspired (+8% vs Feb ’23). Regardless of where they are geographically, investors opinions are shaped by social media, online articles, and crypto-specific media which remain the top sources for insights on cryptocurrency, with experts and friends taking 4th and 5th place respectively.

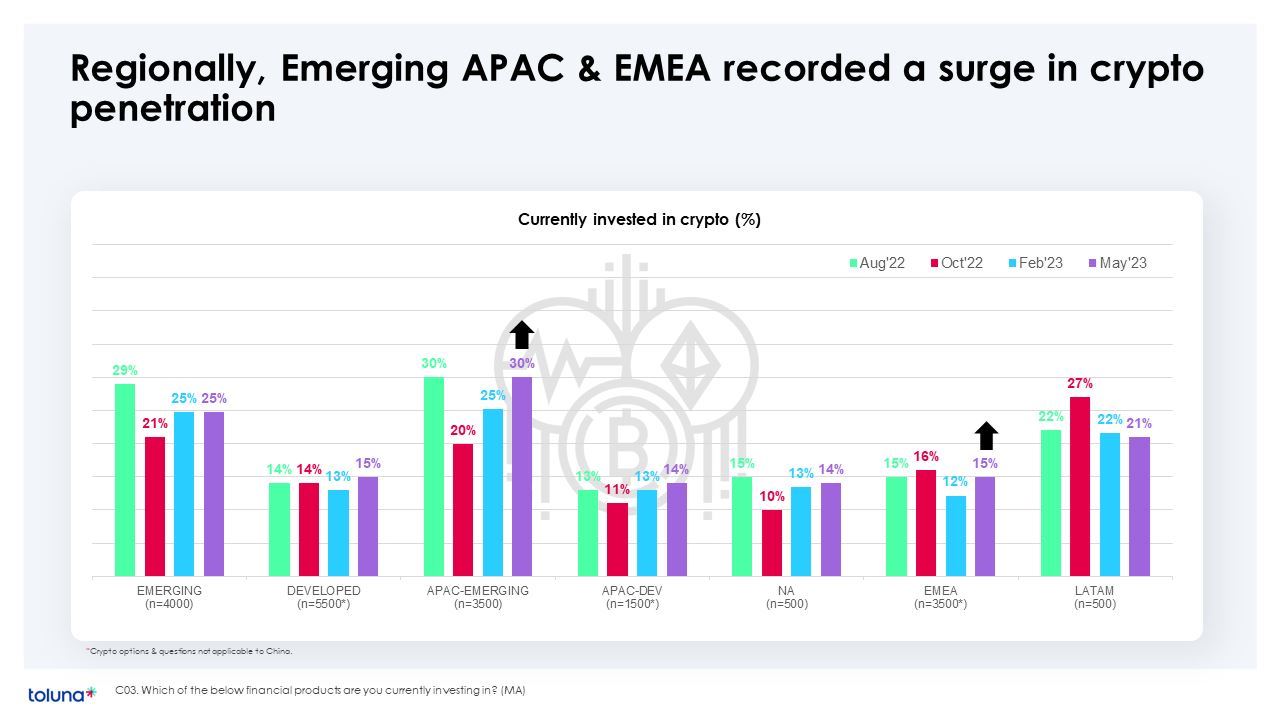

Positive Trends in Penetration

In addition to the positive trends in consumer sentiment, there has been a three-percent increase in global investors vs Q1 ‘23. This is led by Emerging APAC (+5% vs Feb ’23) and EMEA (+3% vs Feb ’23). Crypto investors in Emerging APAC (+6% vs Feb ’23), EMEA (+3% vs Feb ’23) and NA (+10% vs Feb ’23) have increased the proportion of their investible assets into crypto. The opposite is true for LATAM (-2% vs Feb ’23) & Developed APAC (-3% vs Feb ’23), where investors have instead downsized their crypto portfolios.

Commenting on these findings, George Akkaoui, Enterprise Account Director & Office Leader MEA at Toluna, said: “Cryptocurrency has firmly established itself as an integral part of our everyday lives. Major mainstream platforms and even governments, have embraced digital currency payments, solidifying its enduring importance and relevance. Our Q2 2023 study reveals a dynamic landscape for cryptocurrency, with varied sentiments and perceptions among investors globally. These insights are instrumental in understanding the market and shaping the strategies of financial institutions."

In conclusion, while most investors anticipate the continuation of the crypto winter throughout the rest of the year, many maintain cautious optimism about the potential growth of cryptocurrency in the near future. Toluna remains committed to monitoring and analyzing the dynamic landscape of cryptocurrency as the world embraces the digital revolution. As Georges Akkaoui asserts, "Understanding consumer perceptions and investor sentiments is crucial in making informed decisions and shaping strategies that capitalize on the growth potential of cryptocurrencies."